Running a medical practice is a challenging endeavor. In addition to providing top-notch patient care, you must effectively manage the financial aspect of your business. One of the most critical aspects of financial management is maintaining a healthy Accounts Receivable (A/R) process. An efficient A/R system ensures that you receive timely payments for the services you provide. In this article, we will explore strategies to improve your medical practice’s A/R and provide you with a checklist for smooth A/R recovery.

Understanding A/R in Medical Practice

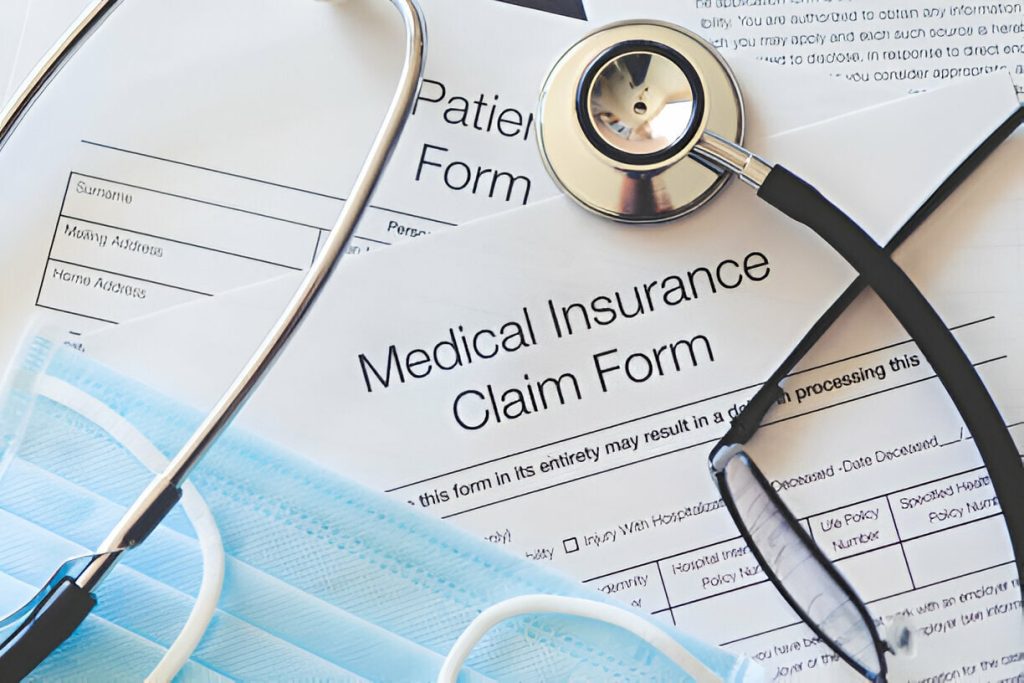

Accounts Receivable often referred to as A/R, represents the total amount of money owed to your medical practice by patients and insurance companies for services rendered but not yet collected. Effective management of A/R is essential to maintain the financial stability of your practice.

Why A/R Management is Crucial

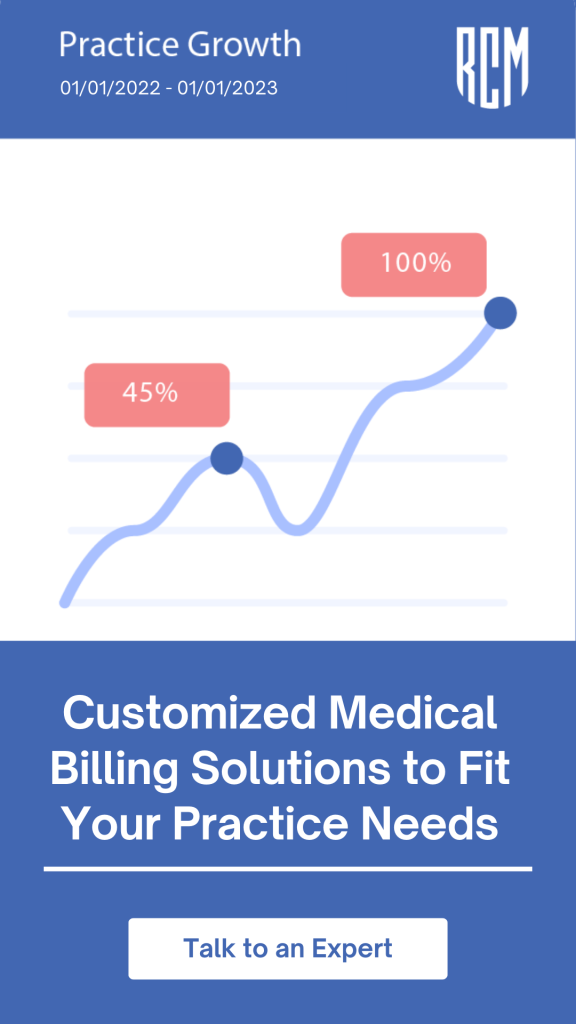

Cash Flow: Efficient A/R management ensures a steady cash flow, allowing you to cover operational expenses, payroll, and investments in practice growth.

Profitability: Timely collections increase practice profitability by reducing the risk of bad debt write-offs.

Patient Satisfaction: A streamlined billing and collections process enhances patient satisfaction by reducing billing errors and confusion.

Compliance: Proper A/R management ensures compliance with regulatory requirements, reducing the risk of audits and penalties.

Strategies to Improve A/R for Your Medical Practice

1 – Streamline Patient Registration:

Collect accurate patient information during registration, including insurance details.

Verify insurance eligibility and benefits before appointments to prevent billing issues later.

2 – Transparency in Billing:

Communicate your practice’s billing policies to patients.

Provide detailed explanations of services and charges on bills to minimize disputes.

3 – Prompt Coding and Billing:

Ensure timely and accurate coding of services to prevent claim denials.

Submit claims promptly to insurance companies to expedite reimbursement.

4 – Automate Billing and Collections:

Implement an electronic health record (EHR) system with integrated billing and collections features.

Use automated reminders and notifications for outstanding balances.

5 – Offer Multiple Payment Options:

Provide convenient payment methods, such as online payments, credit card processing, and payment plans.

6 – Effective Follow-up Procedures:

Develop a structured follow-up process for unpaid claims, including phone calls, emails, and letters.

Set clear timelines for follow-up activities.

7 – Staff Training:

Ensure your staff is well-trained in billing and collections procedures.

Regularly update their knowledge of coding and insurance regulations.

8 – Denial Management:

Establish a dedicated team to manage claim denials promptly.

Analyze denial patterns to address root causes.

9 – Monitor Key Performance Indicators (KPIs):

Track A/R aging reports, collection ratios, and days in A/R to identify areas for improvement.

Set specific targets for KPIs and regularly review progress.

10 – Patient Education:

Educate patients on insurance coverage, copayments, and deductible responsibilities.

Offer financial counseling services to help patients navigate their bills.

A/R Recovery Checklist

To help you navigate the A/R recovery process effectively, here’s a checklist:

- Review A/R Aging Report: Regularly assess your A/R aging report to identify overdue accounts.

- Prioritize Accounts: Prioritize collections efforts based on the age of the account and the likelihood of payment.

- Follow-up Actions: Implement a systematic follow-up process for unpaid accounts, including phone calls, letters, and emails.

- Verify Insurance Claims: Check the status of submitted insurance claims and resubmit if necessary.

- Appeal Denied Claims: Investigate and appeal denied claims to maximize reimbursement.

- Negotiate Payment Plans: Work with patients to set up reasonable payment plans for outstanding balances.

- Utilize Collection Agencies: As a last resort, consider partnering with collection agencies to recover delinquent accounts.

- Regularly Update Billing Policies: Ensure that your billing policies are up-to-date and compliant with current regulations.

- Train Staff: Continuously train and educate your staff on the latest billing and collections practices.

- Evaluate and Adjust: Regularly review your A/R recovery efforts and adjust strategies as needed.

Follow Proper A/R Process

The proper Accounts Receivable (A/R) process in a medical practice involves a systematic approach to billing, collecting, and managing payments from patients and insurance companies. Well-maintained provider credentialing helps as well in smooth A/R recovery for your practice. An efficient A/R process ensures that your practice receives timely reimbursements for services rendered and helps maintain financial stability.

Here’s a step-by-step guide to the proper A/R process:

- Patient Registration and Insurance Verification

- Charge Capture and Coding

- Claim Submission

- Review and Clean Claims

- Electronic Remittance Advice (ERA) Posting

- Patient Billing and Statements

- Follow-Up on Unpaid Claims

- Claim Denial Management

- Appeal Denied Claims

- Patient Collections

- Account Reconciliation

- Credit Balances and Refunds

- Financial Reporting

- Patient Education

- Staff Training and Continuing Education

- Regular Audits and Compliance Checks

- Continuous Improvement

Conclusion

Effective management of Accounts Receivable is essential for the financial health and success of your medical practice. By implementing streamlined billing processes, following up on unpaid claims, and providing transparent communication to patients, you can improve your A/R and maintain a steady cash flow. Use the provided checklist as a guide to help you navigate the A/R recovery process systematically. With the right strategies and consistent effort, you can achieve a healthier bottom line and ensure the long-term sustainability of your practice. Get help from certified medical billers to recover your A/R smoothly and fast.